Treasurer

Kristie Mullins

Treasurer

Business License Tax:

To operate a business in the Town of Gate City, you must obtain a business license. The first year business license fee is $30.00. To renew your license each year, the tax is based on previous year’s gross receipts.

- Contractors: $.11 per $100

- Retailers: $.14 per $100

- Financial, Real Estate and Professional Services: $.41 per $100

- Repair, Personal, Business, and Other Services: $.25 per $100

- Wholesalers: $.05 per $100

- Utilities: $.50 per $100

****For all other business types not listed, please contact the Treasurer for rates.

Transient Lodging Taxes:

The Town collects a transient lodging tax in the amount of 2% of the charge made for each room rented to a transient in a hotel or bed and breakfast. This tax is collected and paid to the Town by the 20th of the month for the previous month.

Disconnection Policy:

Any bill which remains unpaid after the 18th day of the month shall be deemed delinquent. Any account 10 days past due is subject to termination. To reinstate the account: an updated user agreement must be on file; the total account balance paid; the required deposit on file; along with the required service charge to reactivate the meter and/or cover all administrative costs associated with the terminations process.

Surplus Property

Online Auction Services:

The Town of Gate City has contracted with GovDeals to sell surplus items through the internet in order to give the Town an opportunity to auction items throughout the entire year.

Visit www.Govdeals.com and search by Zip code 24251 or by typing in Town of Gate City in the Advanced Search tool to see what surplus items the Town has to offer.

Sales to Employees. Pursuant to the State and Local Government Conflict of Interests Act (Code of Virginia §2.2-3100, et. seq.), employees of the Town of Gate City and their immediate family may only bid on surplus property listed for auction when the total purchase does NOT exceed $500.00. Employees may NOT bid while on duty and may NOT place bids from Town owned computers. All bids conform to the provisions of the State and Local Government Conflict of Interest Act.

If you have questions, please call the Town of Gate City at 276-386-3831.

Meals Tax:

The Town collects Food and Beverage Tax (Meals Tax) payments for any prepared food or beverage offered or held out for sale by a restaurant or caterer for the purpose of being consumed by any individual or group of individuals at one time. This tax is collected and paid to the Town by the 20th of the month for the previous month. Tax is collected at a rate of 4.2% with 3% of the meals tax amount returned as a business commission.

Water & Sewer Bills:

Water & Sewer Bills are due every month on the 18th at 5 pm. *If the 18th falls on a weekend or holiday, the bill will be due the following business day. On the bill due date at 5 pm, we will apply a 10% penalty to the balance of your account and an interest charge of 2% per month.

Payments may be made at the following locations:

- Gate City Town Hall, 156 East Jackson Street (Monday thru Friday 8am to 5pm), walk-in or drive-through window.

- At the drop box located in the front foyer of the Town Hall, open 24 hours.

- Mail your bill to 156 East Jackson Street, Gate City, VA 24251 [br] Online: Pay your bill here.

Bad Checks:

If any check, draft or order for payment of money due the Town for any services not paid by the bank or other depository on which it was drawn, ordered or made because of “no account” or “insufficient funds,” the person by whom such instrument had been tendered, and in addition to other remedies for nonpayment available to the Town, shall be subject to a penalty of thirty ($30.00) dollars to defray the cost of processing the refused or returned instrument; provided however, if such instrument be not paid because of insufficient funds the aforesaid penalty shall be imposed only after the drawer or maker of such instrument fails to deliver payment of the amount owed, or produce evidence of bank error, within five days of receipt by the drawer or maker, or written notice by the Town of nonpayment of instrument due to insufficient funds.

The foregoing notice shall be sent to the drawer or maker by U.S. mail, or hand delivered by a duly certified agent of the Town, to his/her last known address as indicated by the Town’s records, or on the address shown on the instrument should said instrument have a printed address which differs from the address shown on the Town’s records.

Said notice shall be deemed sufficient notice whether or not such notice was returned as undeliverable.

Cigarette Stamps:

$0.20 for each package containing 20 cigarettes, $2.00 per carton, and $0.01 for each cigarette contained in packages of fewer or more than 20 cigarettes sold or used within the town.

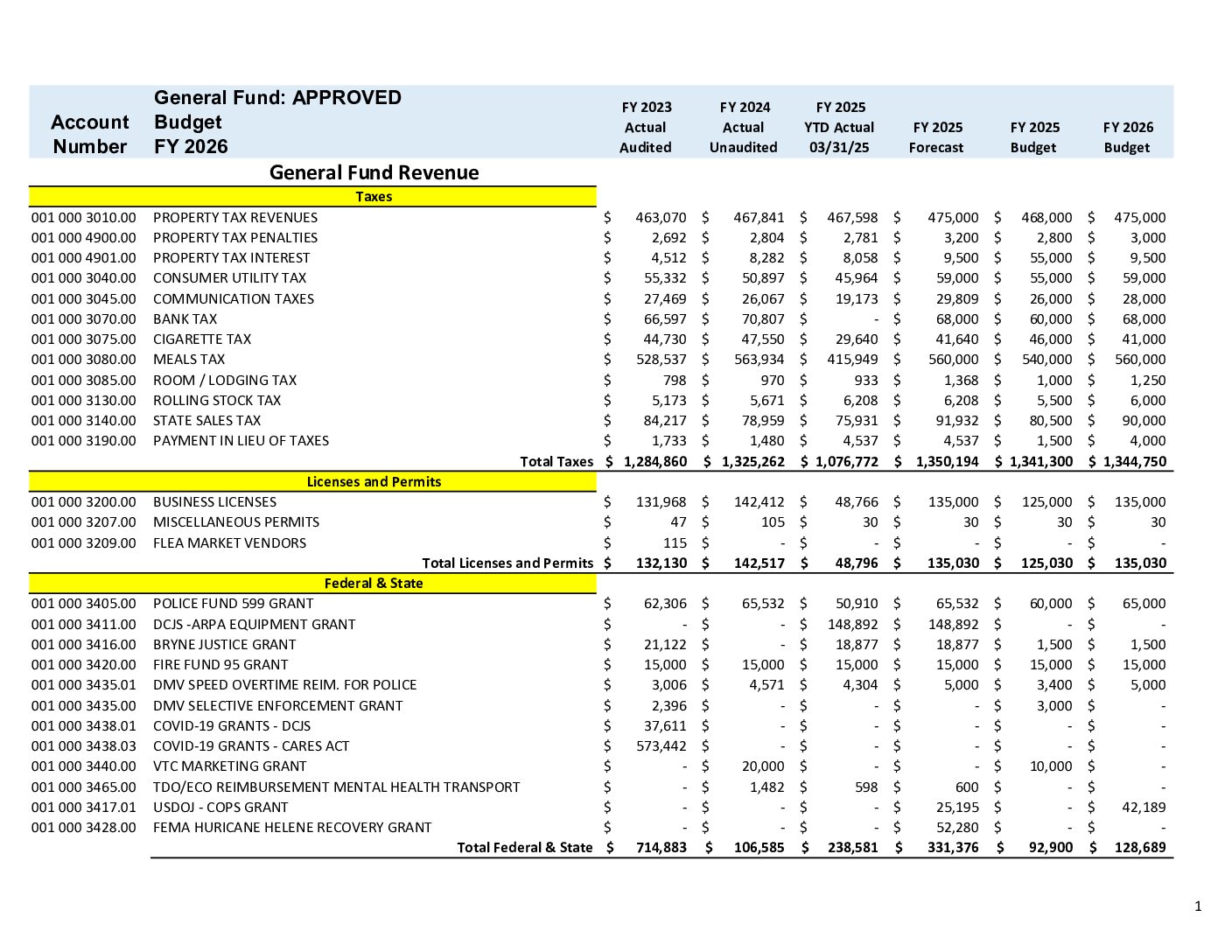

City Estimated Annual Budgets

| Title | Date | Summary | Categories | Image | Link | hf:doc_categories |

|---|---|---|---|---|---|---|

| FY 2026 Town Budget | July 1, 2025 | … | Estimated Annual Budget | estimated-annual-budget |